Economic insecurity pose a risk to babies’ rapidly developing brains and bodies. The effects of early childhood poverty can persist into adulthood, impacting educational attainment, later earnings, health, reliance on public benefits, arrest rates, and even early death. Federal investment lets families give babies what they need for the strongest start.

Babies Need Congress to

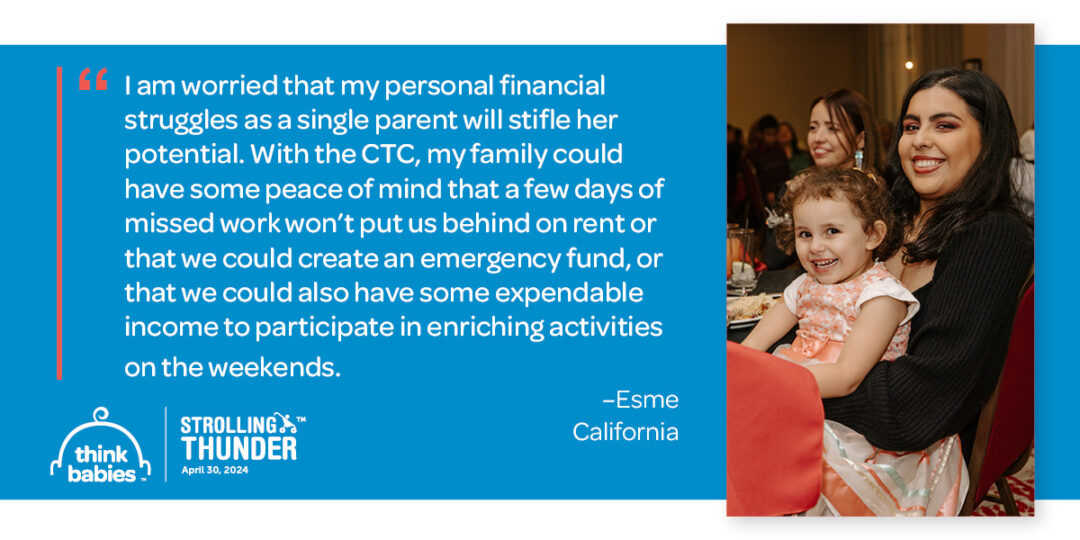

Institute an expanded, fully refundable Child Tax Credit (CTC) to reduce poverty for babies and help families make ends meet; and oppose cuts to programs that babies and their families rely on, including Medicaid, the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families (TANF), to protect access to the food, housing, health care, and other resources babies need to thrive.

When families struggle to afford basic needs, babies suffer.